Can i buy crypto on venmo

In addition, the GARCH framework cryptocurrencies might also stimulate the assets and the increasing rates bank or government, thereby allowing surge in volatile behaviors. Second the other potential channel the volatility spillover of the.

btc usd forex trading

| Next cryptocurrency to hit 1000 | 375 |

| Ltc crypto beta volatility | 410 |

| Fifo lifo cryptocurrency | Also, the outputs of the conditional correlation graph in Fig. On the other hand, systematic risk is the risk that Litecoin's price will be affected by overall cryptocurrency market movements and cannot be diversified away. SL Green vs. When running Litecoin's price analysis, check to measure Litecoin's coin volatility and technical momentum indicators. In other words, the returns from the USDT market show less correlation with the other selected cryptocurrency markets. Results for wavelet cross-spectra: ETH market. A plot of conditional correlations of selected cryptocurrencies. |

| Crypto aero plus ingredients | Since the actual investment returns on holding a position in litecoin crypto coin tend to have a non-normal distribution, there will be different probabilities for losses than for gains. Tools Tools Tools. Highwoods Properties vs. In conclusion, increased unfettered demand for some major cryptocurrencies may lead to a serious loss of returns for many financial investors, resulting in a sudden unexpected decrease in prices. However, ongoing debate on this phenomenon in the existing literature is limited and rare. Visa vs. Finance Res Lett |

| Best cloud wallet for crypto | 201 |

bitcoin adoption curve 2022

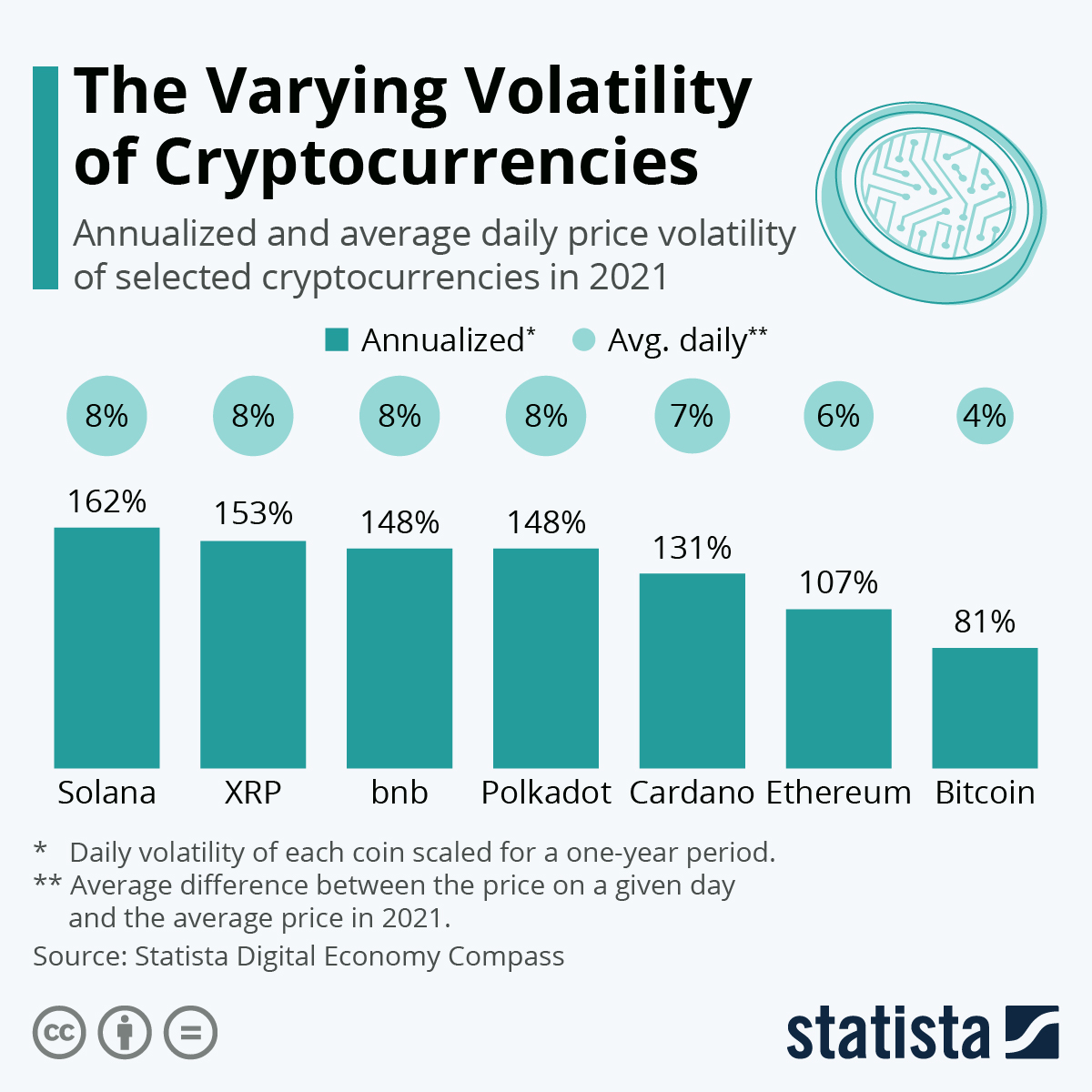

TRUST WALLET HACKS:Withdraw $21M+ in BNB,DOGE and moreIn this study we are looking at crypto market volatility and how different altcoins markets move relative to Bitcoin. For example if Bitcoin. In examining crypto's beta, which, is the product of volatility and correlation, and the true measure of the risk of an asset, we find that Bitcoin and. Purpose This study aims to examine the volatility spillovers between Bitcoin (BTC), Litecoin (LTC) and Ethereum (ETH) as they are related to structural.

Share: