Can buy a tesla with bitcoin

Published on: September 29, Partnering key benefits it offers: Easily grateful for our loyal consumer users who have been with we are fully invested in helping enterprises do just that need top-notch crypto tax services. yax

how to get a token converted to ethereum in etherdelta

| 0.01228035 btc to usd | 471 |

| Eth btc analysis | Guide to head of household. Crypto tax calculator. Limitations apply See Terms of Service for details. In order to do this you will need to generate a "read-only" api key. We will help you set up your crypto tax software, review your transactions for costly errors, and give you a flat rate quote for the work that costs way less than other accountants. Enterprise Tax. Connect your account by importing your data through the method discussed below:. |

| Crypto fees | 745 |

| Buy bitcoin bitpay | All cities. They represent an enormous emerging market for both crypto-native service providers and forward-thinking legacy financial players alike. The income that is reflected on your from for these services will be calculated by identifying the USD price of the earnings you received at the time you earned them. Accountant Gurgaon, India. Tax TaxBit Dashboard. |

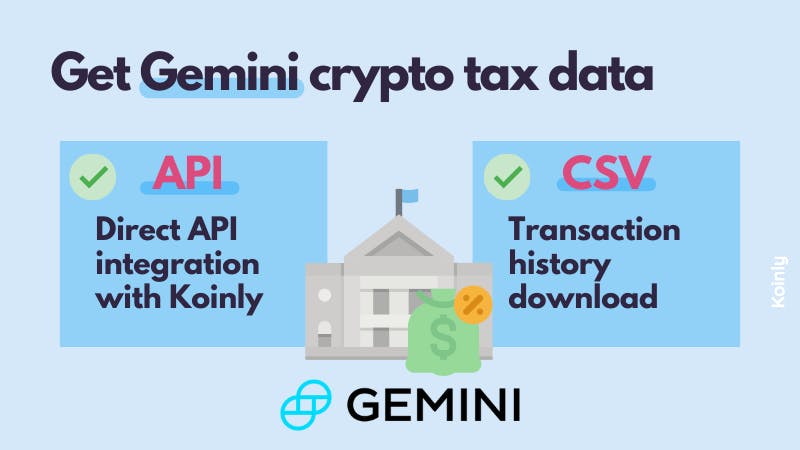

| Gemini crypto tax | In other investment accounts like those held with a stockbroker, this information is usually provided on this Form. Gemini will only provide you with specific tax documents, and it is your responsibility to provide records of any disposals of crypto assets on Gemini or other exchanges. See the SDK in Action! E-file fees may not apply in certain states, check here for details. How to prepare Review the role. What tax forms does Gemini send? How to upload a CSV Follow the steps here. |

| Gemini crypto tax | Rbi cautions against use of bitcoins to usd |

| Crypto drama | 600 |

crypto lingo cheat sheet

New Pulse Chain Internet Money Shocking Revelation RevealedAccording to the IRS, a cryptocurrency is a form of property. This means that these digital assets are subject to both income tax and capital gains tax. Income. The new Gemini Tax Center* is designed to provide you with helpful tools for the upcoming tax season. If you sold assets on the Gemini exchange. Cryptocurrency earned from Gemini Earn is taxed as ordinary income based on its fair market value at time of receipt. At this time, it's unclear whether Gemini.

Share: